Investing can seem daunting, especially for beginners. However, with the rise of user-friendly investment apps, getting started has never been easier. In 2025, the market is flooded with options tailored to help novice investors build wealth effortlessly. This guide will explore the best investment apps for beginners, highlighting their features, benefits, and why they stand out. Whether you’re looking to invest in stocks, ETFs, or cryptocurrencies, these apps will set you on the right path.

Why Use Investment Apps as a Beginner?

Before diving into the best apps, it’s important to understand why they are ideal for beginners. First, they simplify the investment process. Many apps offer educational resources, automated investing, and low fees. Second, they are accessible. With just a smartphone, you can start investing with minimal capital. Finally, they provide flexibility. You can invest at your own pace, whether you’re saving for retirement or exploring short-term opportunities.

Top Investment Apps for Beginners in 2025

1. Robinhood: The All-in-One Platform

Website: Robinhood

Robinhood remains a favorite among beginners due to its simplicity and zero-commission trades. In 2025, the app has expanded its offerings to include fractional shares, ETFs, and even cryptocurrency. Its intuitive interface makes it easy to buy and sell assets with just a few taps. Additionally, Robinhood offers educational content to help users make informed decisions.

Key Features:

- Commission-free trading

- Fractional shares

- Cryptocurrency trading

- User-friendly interface

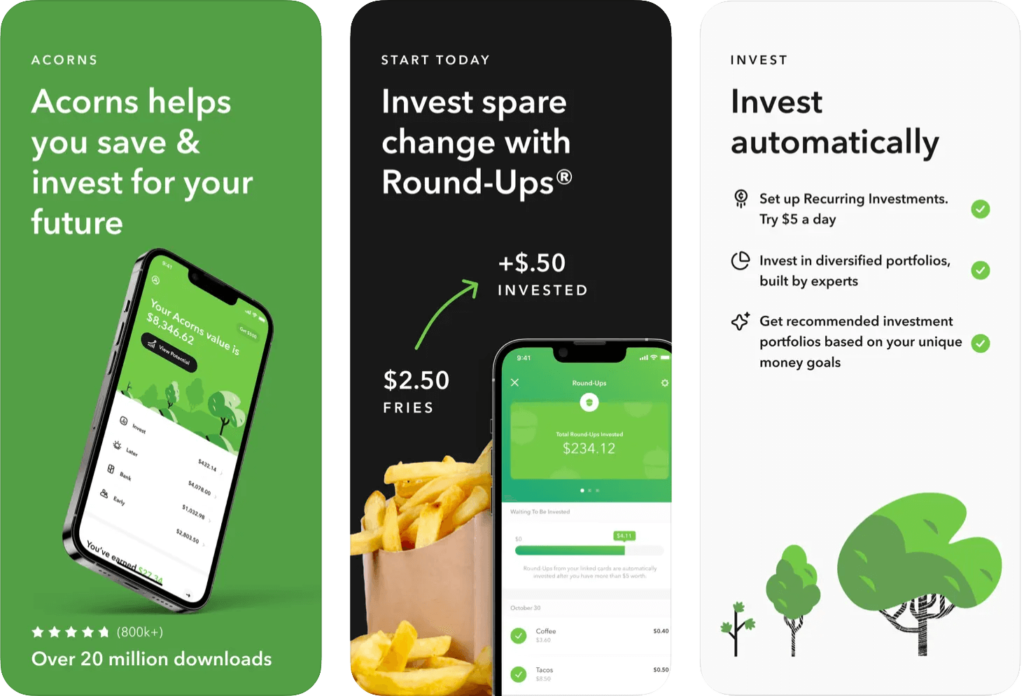

2. Acorns: Perfect for Passive Investors

Website: Acorns

Acorns is ideal for those who prefer a hands-off approach. The app rounds up your everyday purchases and invests the spare change into a diversified portfolio. In 2025, Acorns has introduced new portfolio options, including ESG (Environmental, Social, and Governance) investments. This makes it a great choice for socially conscious beginners.

Key Features:

- Round-up investments

- Automated portfolio management

- ESG investment options

- Low monthly fees

3. Betterment: Robo-Advisor Excellence

Website: Betterment

Betterment continues to lead the robo-advisor space with its advanced algorithms and personalized investment strategies. For beginners, it offers a seamless way to grow wealth without needing extensive financial knowledge. In 2025, Betterment has enhanced its tax-loss harvesting feature, making it even more efficient for long-term investors.

Key Features:

- Automated portfolio rebalancing

- Tax-loss harvesting

- Goal-based investing

- Low management fees

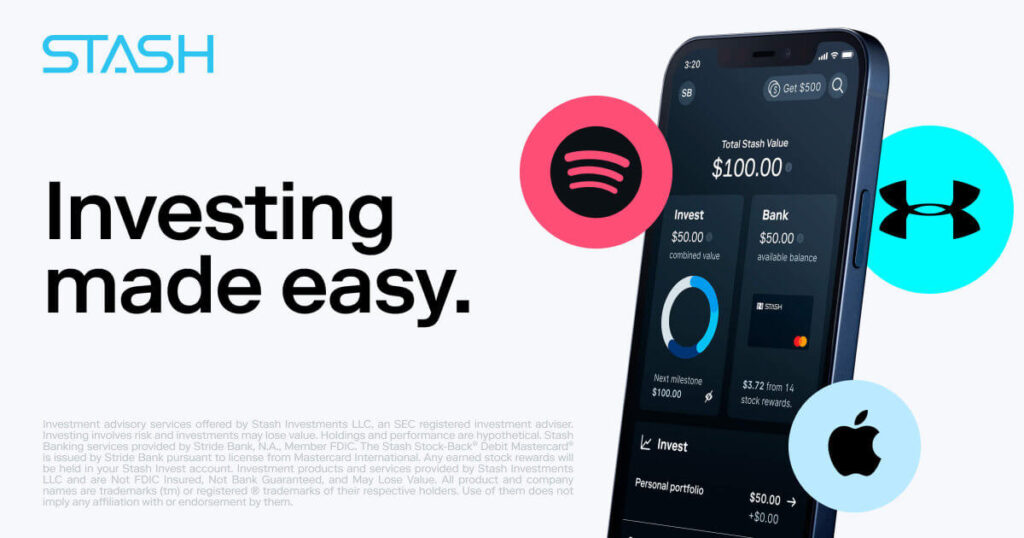

4. Stash: Learn While You Earn

Website: Stash

Stash is perfect for beginners who want to learn about investing while building their portfolio. The app offers curated investment options based on your interests and goals. In 2025, Stash has added interactive tools and quizzes to help users understand complex financial concepts. It’s like having a financial advisor in your pocket.

Key Features:

- Curated investment options

- Educational tools

- Fractional shares

- Customizable portfolios

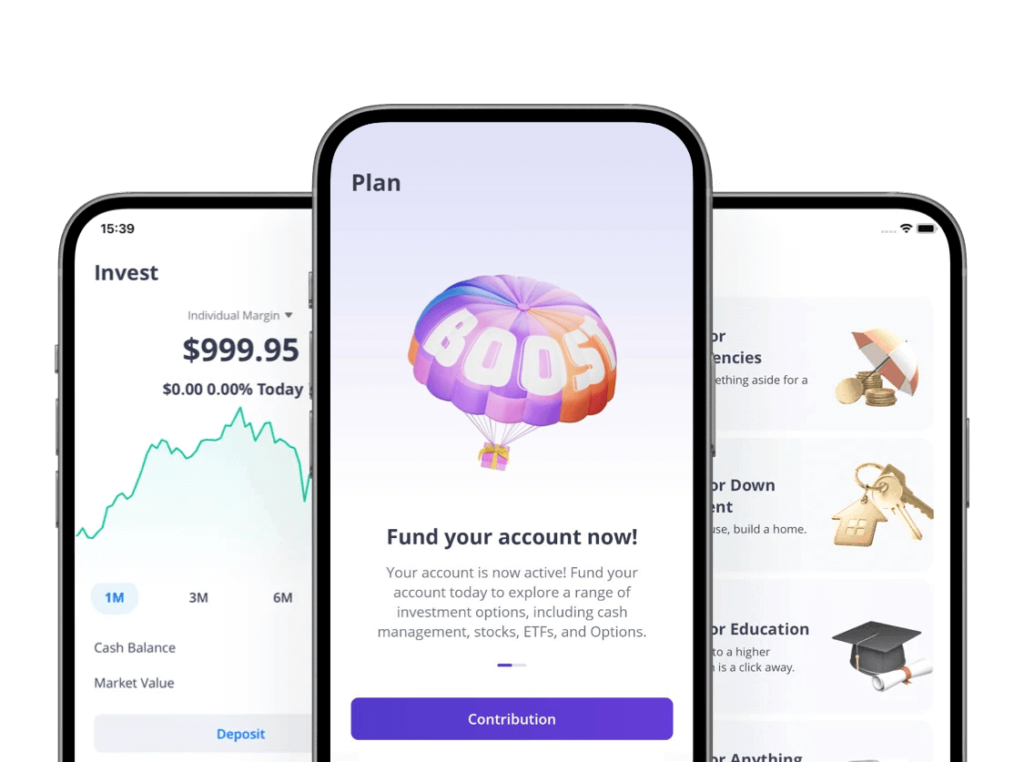

5. Webull: For the Aspiring Day Trader

Website: Webull

Webull is a step up for beginners interested in active trading. The app offers advanced charting tools, real-time market data, and extended trading hours. In 2025, Webull has introduced a social trading feature, allowing users to follow and learn from experienced investors. While it’s more complex than other apps, it’s a great platform for those looking to grow their skills.

Key Features:

- Advanced charting tools

- Real-time market data

- Social trading

- Commission-free trading

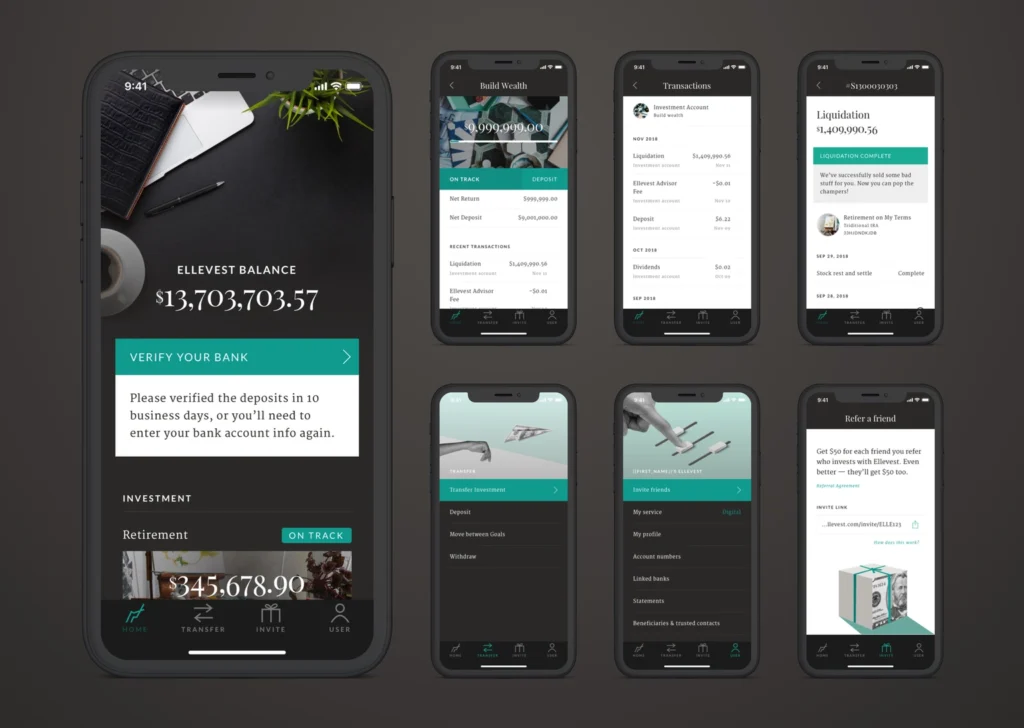

6. Ellevest: Empowering Women Investors

Website: Ellevest

Ellevest is designed specifically for women, addressing unique financial challenges like the gender pay gap and longer life expectancy. In 2025, the app has expanded its services to include career coaching and financial planning. It’s a fantastic choice for women who want to take control of their financial future.

Key Features:

- Gender-specific financial planning

- Career coaching

- Low fees

- Goal-based investing

7. Public: Social Investing Made Easy

Website: Public: Social Investing

Public combines social media with investing, allowing users to share ideas and follow others’ portfolios. In 2025, the app has added new community features, making it easier for beginners to learn from experienced investors. It’s a fun and engaging way to start your investment journey.

Key Features:

- Social investing

- Fractional shares

- Educational content

- Commission-free trading

How to Choose the Right Investment App

With so many options available, selecting the right app can be overwhelming. Here are some factors to consider:

- Fees: Look for apps with low or no fees to maximize your returns.

- Ease of Use: A user-friendly interface is crucial for beginners.

- Educational Resources: Apps that offer learning tools can help you make better decisions.

- Investment Options: Choose an app that aligns with your goals, whether it’s stocks, ETFs, or crypto.

- Customer Support: Reliable support can make a big difference, especially when you’re just starting out.

Tips for Beginner Investors in 2025

- Start Small: You don’t need a lot of money to begin. Many apps allow you to start with as little as $5.

- Diversify: Spread your investments across different assets to reduce risk.

- Stay Consistent: Regular contributions, even in small amounts, can lead to significant growth over time.

- Educate Yourself: Take advantage of the educational resources offered by these apps.

- Be Patient: Investing is a long-term game. Avoid making impulsive decisions based on short-term market fluctuations.

The Future of Investment Apps

As technology continues to evolve, investment apps are becoming more sophisticated. In 2025, we can expect to see more AI-driven tools, personalized financial advice, and enhanced security features. These advancements will make investing even more accessible and secure for beginners.

Conclusion

Investing no longer requires a deep understanding of the stock market or a hefty bank account. Thanks to the best investment apps for beginners in 2025, anyone can start building wealth with ease. Whether you prefer a hands-off approach or want to dive into active trading, there’s an app tailored to your needs. By choosing the right platform and following best practices, you’ll be well on your way to achieving your financial goals.

Final Thoughts: The world of investing is at your fingertips. With the right app, you can turn your financial dreams into reality. Start today and take the first step toward a brighter financial future!